Just-In-Case Inventory Management Strategy Explained

In the early 1980s, just in time supply chain management emerged as a way for businesses to reduce stock levels and only hold items that were needed to fulfill known orders.

In recent years, and particularly since the coronavirus pandemic, just-in-case (JIC) supply chain management has become more popular.

This takes a more cautious approach, where companies carry more stock and add redundancy into their supply chain, so they can respond to unexpected surges in demand or mitigate supply disruption.

While increasing stock levels will increase carrying costs and tie up capital, it could still be more profitable in the long run. Having the right stock available could generate more sales and help businesses gain a competitive advantage.

The ability to quickly respond to market changes also means businesses are in an excellent position to facilitate growth.

In this post, we explain how you can implement a just-in-case stock management strategy without the risk of tying up too much capital in unnecessary inventory items.

How to implement JIC inventory management with optimum stock levels

Just in case inventory management doesn’t have to mean inflating stock to really high levels. With some simple tactics, you can use this approach to mitigate supply chain risk while keeping inventory investment under tight control.

The key elements of inventory management to support your JIC stock strategy are:

- Accurate demand forecasting

- Using safety stock

- Anticipating stock outs – especially of essential stock items

- Stock classification

- Track excess stock to prevent obsolescence

Let’s look at each in more detail.

Accurate demand forecasting is critical for JIC inventory management

Just-in-case inventory management shouldn’t be about carrying as much stock as possible to cover up poor forecasting practices. Accurate demand forecasting is fundamental to a successful JIC approach. It’s critical to find the right balance between meeting demand without over-investing in unnecessary stock.

To get precise forecasting, you should combine historical sales or demand data (quantitative forecasting) with market knowledge of potential fluctuations (qualitative forecasting). Adding ‘human input’ to statistical calculations is very useful during times of market instability.

Factors to consider for accurate demand forecasting

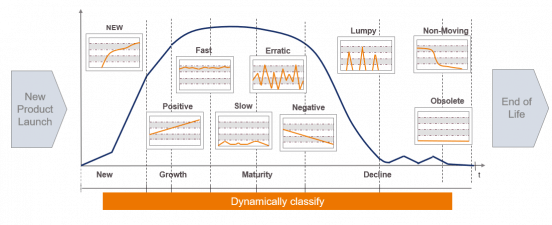

When preparing forecasts, it’s important to consider where your stock items sit in their product lifecycle. This is because an item has a different demand profile at each stage, which will affect how you calculate its forecast.

Knowing each inventory item’s demand profile or type will help you choose the best algorithms to calculate demand for the most accurate forecast.

Other factors to consider that will affect demand accuracy include:

- Demand trends – product demand will change due to fashions, technological changes, and social, economic and legal factors.

- Seasonal demand – religious festivals and seasonal weather patterns can affect purchasing habits.

- Qualitative inputs – these include future events and external market factors, such as sales promotions and competitor activities.

Check demand outliers

During times when demand is unpredictable, you may see more outliers, e.g. when actual demand is much higher or lower than the forecast.

Demand outliers can skew upcoming forecasts, so it’s important to review them and decide whether or not to include them in your predictions.

Remove periods of stockouts

It’s also important to remove periods when items have been out-of-stock from forecasts. It’s not wise to base upcoming forecasts on these past demand levels as they will be too low.

This can be done by simply removing the demand or identifying lost sales volumes and building them back into the forecast.

Calculating safety stock for better JIC stock management

Safety stock is used by many companies who implement just-in-case stock strategies, as it helps them deal with supply chain disruptions or spikes in demand.

Safety stock is also critical to achieving stock availability targets without carrying unnecessary stock. It’s therefore essential to get safety stock levels accurate.

There are many ways to calculate safety stock, from simply adding a fixed amount of buffer stock to all items to using statistical calculations that account for demand and lead time variance.

It’s important to understand that safety stock is an additional level of stock above your usual cycle stock. The idea is that once you’ve used up your cycle stock (stock you were expecting to sell based on your forecast), you still have some contingency for unexpected changes in demand or supply.

Safety stock should be calculated in addition to your usual stock levels. You can then adjust them, based on your understanding of supply and demand volatility, without interfering with your usual stocking policies.

Anticipating stockouts with JIC inventory strategies

If you can ‘foresee’ potential upcoming stock shortages, you can act before there’s a stockout. You can also use this information to adjust reordering parameters and safety stock levels to prevent the same thing from reoccurring.

A risk of run out report will help you understand what stock items are most ‘at risk’ of running out, when they are likely to run out, and how much you are likely to be short.

It’s a more reactive tactic, but one that can help you keep overall stock levels down and simply react to upcoming risks.

With this crucial information to hand, your team can put a plan in place to deal with the consequences, like organize an emergency order, communicate with the sales team, or redistribute stock.

Stock classification and JIC stock management

The number one rule to success with a just in case stock strategy is: do not treat all items the same! A JIC approach will be much more effective if you use it to varying degrees across your inventory. It’s not wise to treat all items the same, as some will be more at risk of erratic lead times or lumpy demand than others.

Classifying your stock helps prevent a ‘blanket approach’. Using ABC analysis will help you categorize your stock items and assign different stocking policies to each group.

For example, with your inventory split into three groups, you could decide to prioritize forecasting and carry more safety stock of your A items, as they have the most supply chain ‘risk’ and demand volatility than your B and then C items.

A more advanced approach would be to use picks classification. Then you can identify items that you pick and sell most frequently and ensure you use a JIC stock policy to improve availability: increase safety stock, include in a risk of run out report, etc.

As an item’s pick frequency drops off, you can reduce the need for the JIC stocking policies.

Tracking excess stock levels

A big risk of using a just in case approach is that it could lead to excessive levels of stock that could be difficult to move and end up obsolete.

One way to prevent this is to track the ‘health’ of your stock:

Healthy stock – when stock levels are healthy, they reflect your demand forecasts. With a JIC policy, you may also have a pre-calculated additional level of safety stock that you may dip into now and again.

Excess stock – overstocking is when you have a lot of stock sitting on shelves that is not moving and is well over the quantities stipulated by your forecasts. It is important to keep an eye on these levels, as stock can begin to perish, be superseded by newer models, or lose market value.

Obsolete stock – when a stock item has had no demand over a number of periods it can be classed as obsolete. At this point, items begin to affect your bottom line, so act before you reach this stage!

Using inventory optimization software to implement your JIC strategy

Keeping on top of the many reports needed to manage a just-in-case inventory plan may sound like a daunting task. However, inventory optimization software can help.

Inventory optimization software can help classify stock accurately, forecast demand, calculate optimal safety stock levels, and run risk of run out reports.

With all the above information in one system, you can have complete visibility across your entire stock portfolio.

Plus, with a host of alerts to highlight demand outliers, items at risk of runout or showing signs of obsolescence, EazyStock makes it easier to act before the risks become a reality.

You’ll also give your inventory teams more time to deal with suppliers, manage customers and look at the bigger picture.

If you’d like to know more about EazyStock, why not arrange a quick call with one of our team.